Tax Forms For 401K Contributions . you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. You put £15,000 into a private pension. Find out how the government tops up your pension savings in the form of pension tax relief, and. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. confused about 401(k) tax rules? contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. A 401(k) is a feature of a. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them.

from clients.sensefinancial.com

A 401(k) is a feature of a. Find out how the government tops up your pension savings in the form of pension tax relief, and. you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. confused about 401(k) tax rules? You put £15,000 into a private pension. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered.

Contributions

Tax Forms For 401K Contributions contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. confused about 401(k) tax rules? Find out how the government tops up your pension savings in the form of pension tax relief, and. You put £15,000 into a private pension. A 401(k) is a feature of a. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040.

From www.401kmaneuver.com

How to Read a 401(k) Statement and Understand It 401k Maneuver Tax Forms For 401K Contributions confused about 401(k) tax rules? you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. Find out how the government tops up your pension savings in the form of. Tax Forms For 401K Contributions.

From www.sampletemplates.com

7+ Sample 401k Calculators Sample Templates Tax Forms For 401K Contributions unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. Find out how the government tops up your pension savings in the form of pension tax relief, and. A 401(k). Tax Forms For 401K Contributions.

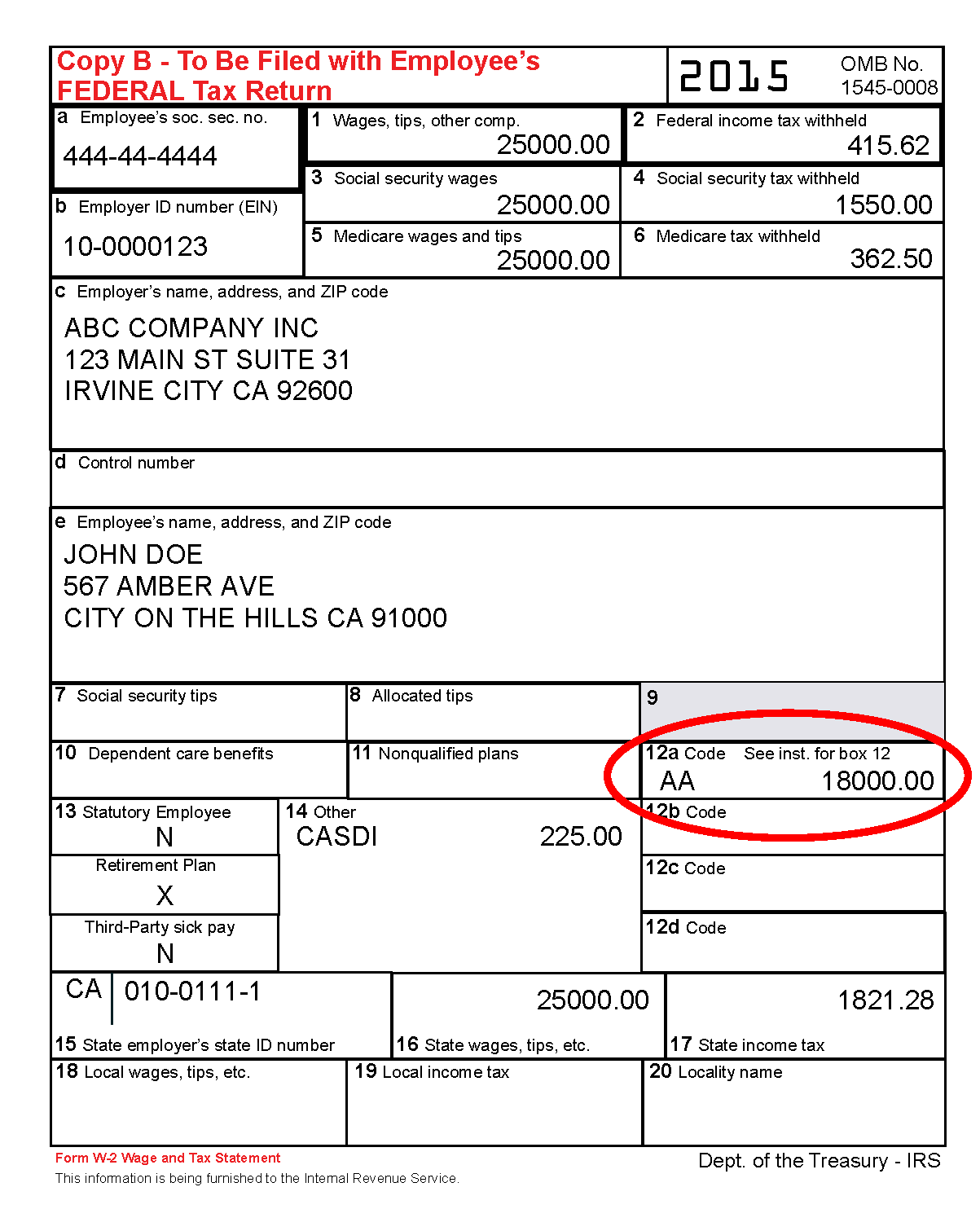

From library.myguide.org

Lets's understand W2 Boxes and W2 tax Codes A Guide by MyGuide Tax Forms For 401K Contributions contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. You put £15,000 into a private pension. A 401(k) is a feature of a. confused about 401(k) tax rules? Find out how the government tops up your pension savings in the form of. Tax Forms For 401K Contributions.

From dxouhkagz.blob.core.windows.net

Tax Forms Related To 401K at Carrie Gaylor blog Tax Forms For 401K Contributions Find out how the government tops up your pension savings in the form of pension tax relief, and. contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. You put £15,000 into a private pension. learn about internal revenue code 401(k) retirement plans. Tax Forms For 401K Contributions.

From www.signnow.com

401 K Enrollment Form Complete with ease airSlate SignNow Tax Forms For 401K Contributions You put £15,000 into a private pension. A 401(k) is a feature of a. you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. learn about internal revenue code. Tax Forms For 401K Contributions.

From www.forbes.com

Understanding Your Tax Forms The W2 Tax Forms For 401K Contributions You put £15,000 into a private pension. A 401(k) is a feature of a. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. contributions to a traditional 401(k). Tax Forms For 401K Contributions.

From www.youtube.com

How to report a 1099 R rollover to your self directed 401k YouTube Tax Forms For 401K Contributions A 401(k) is a feature of a. You put £15,000 into a private pension. confused about 401(k) tax rules? contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. you earn £60,000 in the 2024 to 2025 tax year and pay 40%. Tax Forms For 401K Contributions.

From www.solo401k.com

How to File IRS Form 1099R Solo 401k Tax Forms For 401K Contributions unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. confused about 401(k) tax rules? you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. Find out how the government tops up your pension savings in the form of. Tax Forms For 401K Contributions.

From www.keepingupwiththebulls.com

Max Out Your 401(k) Contributions in 2020 Keeping Up With The Bulls Tax Forms For 401K Contributions unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. Find out how the government tops up your pension savings in. Tax Forms For 401K Contributions.

From www.solo401k.com

Solo 401k Contribution Calculator Walk Thru Solo 401k Tax Forms For 401K Contributions confused about 401(k) tax rules? learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as. Tax Forms For 401K Contributions.

From www.solo401k.com

What to do if you have to take an early withdrawal from your Solo 401k Tax Forms For 401K Contributions you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. confused about 401(k) tax rules? Find out how the government tops up your pension savings in the form of pension tax relief, and. You put £15,000 into a private pension. A 401(k) is a feature of a. unless you're a business. Tax Forms For 401K Contributions.

From www.financestrategists.com

AfterTax 401(k) Contribution Definition, Pros, Cons, & Rollover Tax Forms For 401K Contributions confused about 401(k) tax rules? learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. You put £15,000 into a private pension. A 401(k) is a feature of a. Find out how the government tops up your pension savings in the form of pension tax relief, and. you earn £60,000 in. Tax Forms For 401K Contributions.

From www.scribd.com

Adp 2019 02 12 PDF PDF Irs Tax Forms 401(K) Tax Forms For 401K Contributions contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. A 401(k) is a feature of a. learn about internal. Tax Forms For 401K Contributions.

From www.formsbank.com

401(K) Contribution Authorization Form printable pdf download Tax Forms For 401K Contributions contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. Find out how the government tops up your pension savings in the form of pension tax relief,. Tax Forms For 401K Contributions.

From mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog Tax Forms For 401K Contributions you earn £60,000 in the 2024 to 2025 tax year and pay 40% tax on £10,000. A 401(k) is a feature of a. You put £15,000 into a private pension. contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or dividends), are considered. Find out how. Tax Forms For 401K Contributions.

From www.formsbank.com

18 401k Form Templates free to download in PDF Tax Forms For 401K Contributions learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. A 401(k) is a feature of a. You put £15,000 into a private pension. Find out how the government tops up your pension savings in the form of pension tax relief, and. confused about 401(k) tax rules? contributions to a traditional. Tax Forms For 401K Contributions.

From ceqxakif.blob.core.windows.net

Tax Forms For 401K at Michael Ison blog Tax Forms For 401K Contributions A 401(k) is a feature of a. unless you're a business owner, you won't claim your 401 (k) contributions as tax deductible when you fill out your form 1040. Find out how the government tops up your pension savings in the form of pension tax relief, and. You put £15,000 into a private pension. contributions to a traditional. Tax Forms For 401K Contributions.

From www.annuity.org

401(k) Plans What Is a 401(k) And How Does It Work? Tax Forms For 401K Contributions learn about internal revenue code 401(k) retirement plans and the tax rules that apply to them. A 401(k) is a feature of a. You put £15,000 into a private pension. confused about 401(k) tax rules? contributions to a traditional 401(k) plan, as well as any employer matches and earnings in the account (such as gains, interest or. Tax Forms For 401K Contributions.